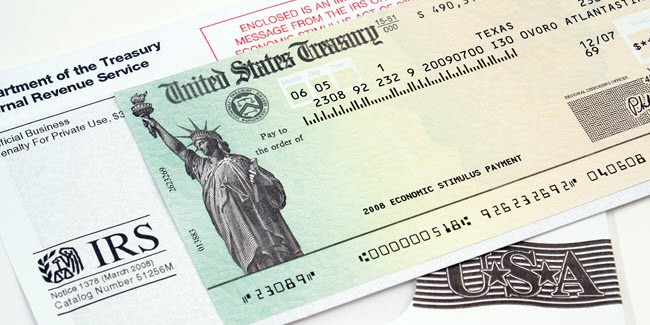

Lawmakers Clarifiy Stimulus Payments Will Not Be Taxed

Lawmakers in Alabama clarified that families and businesses in the state that will receive the stimulus payments would not be taxed if legislative actions would be taken.

Several lawmakers in Alabama want to ensure that people who will receive $1,200 direct stimulus payments and Paycheck Protection Program loans to businesses will not be taxed. However, the state's statutes must be tweaked to match the federal law.

In a recently published article in Times Daily, Republican Senator Dan Roberts from Mountain Brook said that no one extends to tax the money. He also added that the money intends to stimulate the economy and help people make it through this pandemic.

However, the Republican senator asserted that legislation needs to be passed, and that is what they are doing. Sen Roberts shared that in the late 2020 legislative session, he, along with other lawmakers, proposed clarifying the proposed law that the stimulus payments and loan forgiveness are not taxable.

However, the legislation proposal went hanging and dead because the House wanted to focus solely on state budget bills and local legislation. At present, Sen. Roberts is working on a new bill that combines tax exemptions with his previously filed bill that does not include tax stimulus payments and PPP Loans.

He also asserted that his proposed legislation is ready to go for deliberation on the floor once Alabama Governor Kay Iver calls for a special session this year. However, the bill will be pre-filed in the 2021 regular session that will begin in February if a special session will not be called.

Another Republican Senator Chris Elliott from Fairhope supported Roberts. In fact, he said that the issue of not taxing the stimulus payments and the PPP Loans should have been resolved. He is also frustrated because there was an ability to fix this issue last session, but it was not allowed.

Moreover, Elliott will also file his own legislation that only addresses the coronavirus relief fund's untaxing. He said, "If Sen. Roberts' bill passes, with the language I've put forth, I'm completely fine with it," Additionally, Rep. Arnold Mooney, R-Birmingham, also filed a two-page bill in May that excludes relief funds from state taxes.

Rep. Mooney is also planning to file his bill again in the next session. Mooney explained, "We thought it was something that needed to be done to tell the people of Alabama that it's not our intent to tax this money. I like the idea of expressing that in a straight-up and straightforward way."

Mooney asserted that people who have lost their jobs due to the global pandemic should not have to worry about taxes on their stimulus payment or relief money. The Republican Representative emphasized that people don't need to get stressed that they already have because of the pandemic.

According to the Alabama Department of Revenue, some, but not all, Alabamians will be taxed if the lawmakers will not act. The taxes will include the $1,200 stimulus payments. The same thing also will happen to the small businesses that we're able to receive the PPP Loans.

Check these out!

Subscribe to Latin Post!

Sign up for our free newsletter for the Latest coverage!

© 2025 Latin Post. All rights reserved. Do not reproduce without permission.