IRS Clarifies Who Qualifies for the Next Stimulus

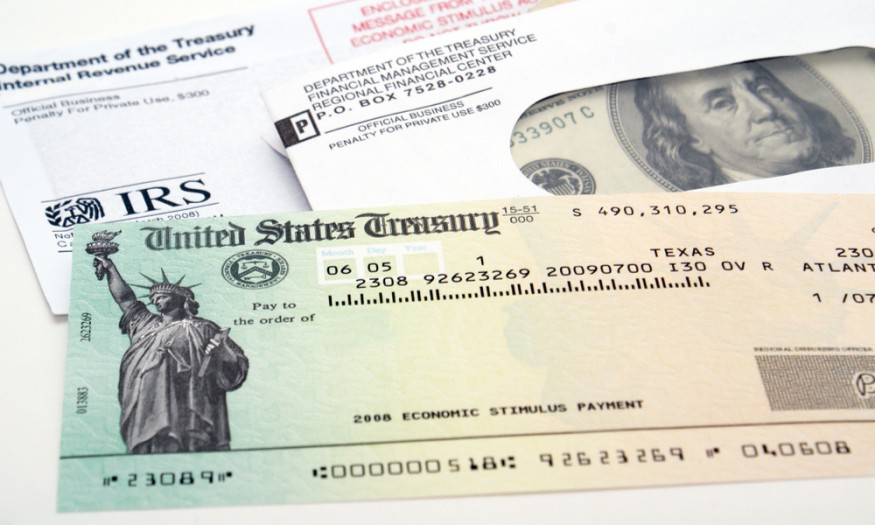

The Internal Revenue Service (IRS) clarifies that many older people may be eligible for the second round of stimulus checks. Here are the rules and exceptions.

The IRS clarifies the requirements and qualifications for the next round of stimulus checks, most especially for older adults and retired individuals. Their tax filings, Average Gross Income, their pension, including if they are part of the Social Security Disability Insurance program and whether or not you count as a dependent on the IRS all contribute to receiving the first stimulus check.

The stimulus negotiation between the U.S. Treasury Secretary Steven Mnuchin and House Speaker Nancy Pelosi has signs of progress and developments. This means that there is a chance for the second round of stimulus checks and other relief aids.

Older adults and retired individuals should know the eligibility for the second round of stimulus checks. There are important things as well on how they can get the money quickly. Here are some important things that you should know from the IRS:

1. How the IRS Count You As An Older Adult?

IRS considers a person as an older adult if he or she ages 65 years old above at the end of 2019. They are considered senior on their taxes on that year ad beyond.

2. How to Know If You Are Eligible for the Next Stimulus Check?

The best way to know if you are eligible for the next stimulus check is to base it on your Adjusted Gross Income from your 2019 tax filing. Pension and investments are taxable; they will affect your AGI, and this also means that this will also affect your eligibility for stimulus checks.

3. What Does IRS Count As An Income?

Your gross income includes income from sources outside of the U.S., from selling your main home, and gains. These are reported on Form 8949 or Schedule D. Your gross income does not include any social security benefit unless:

- You are married, but filing separated and lived with your spouse at some point in 2019.

- Half of your social security benefits plus your other gross income and any tax-exempt interest is more than $25,000 filing single (or $32,000 if married filing jointly).

4. What If You Did Not Get the First Check?

If you are 65 years old and above but were not able to receive your first stimulus check under CARES Act in March, you should track the status of your missing direct stimulus by visiting the website using the Get My Payment webpage or try to contact the IRS by phone.

5. Do Older People Need to File Tax Returns?

The requirement to file a tax return depends on your gross income, which is all income you receive in the form of money, goods, property, and services that are not tax-exempt. For 2019, the standard deduction amount for single filers was $12,200.

Always remember that your gross income is different from your Adjusted Gross Income which is your gross income minus any eligible adjustments that you may qualify for.

Check these out!

Subscribe to Latin Post!

Sign up for our free newsletter for the Latest coverage!