Student Loan Forgiveness Application: Are You Eligible for Up to $20,000 Debt Relief? Here's How to Apply

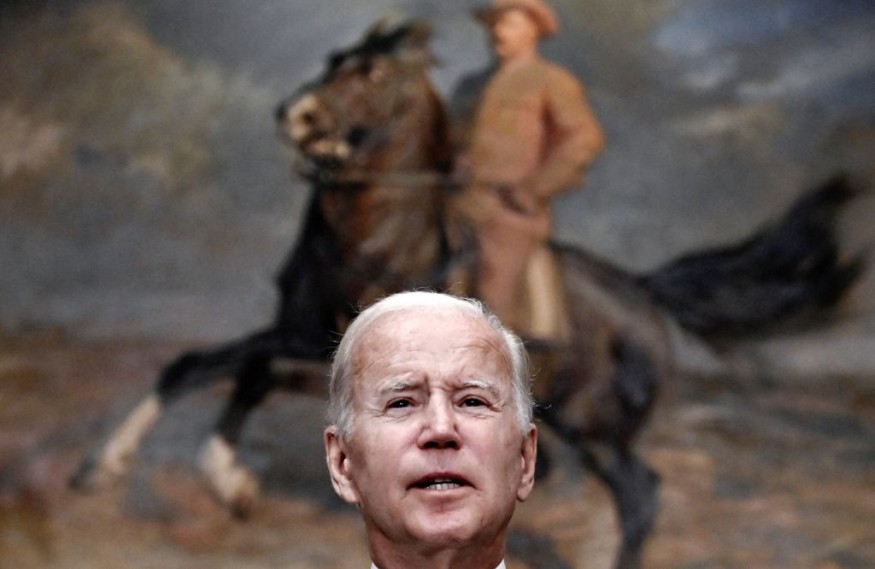

U.S. President Joe Biden announced on Monday that the student loan forgiveness application has formally launched, noting that the program is a game changer for millions of Americans.

CNN News reported that applicants can fill out the form in English or Spanish at Studentaid.gov, with the form including information on the debt relief, who qualifies, and how it works.

The application form also asks for information such as full name, Social Security number, date of birth, phone number, and email address.

Eligible borrowers can submit their application until Dec. 31, 2023.

READ NEXT : Joe Biden Administration Narrows Eligibility for Student Loan Forgiveness | Here's What Changed

Student Loan Forgiveness Eligibility

Most people with federal student loans who are below the income threshold would qualify for Biden's plan.

Undergraduate loans, graduate loans, and Parent Plus loans under the Education department are all qualified for cancellation, according to a Washington Post report.

Initially, people with privately held loans from the defunct Federal Family Education Loans program could gather into a Direct Loan to be eligible for relief.

However, the Education Department rescinded the decision in late September and announced that it would no longer allow the borrowers to take advantage of Biden's cancellation program.

The department noted that it is still looking for a solution to expand relief.

Student loan forgiveness is limited to borrowers who earned less than $125,000 in 2020 or 2021 or less than $250,000 for married couples.

The agency previously said that applications filed during the beta test will be processed once the application is officially launched.

The Education Department noted that about one million and five million borrowers may be required to submit more information to verify the income or eligibility of the applicants.

Office Management and Budget noted that applicants who showed a higher likelihood of exceeding the income threshold will probably have to hand out more documentation to provide their income.

Student Loan Forgiveness

The amount of student loan canceled will depend on whether or not the borrower received a Pell Grant.

Those who received it will be given up to $20,000 in debt cancellation. Other borrowers will receive $10,000 in debt cancellation, as reported by Forbes.

The relief will be capped at the amount of the outstanding debt if the student loan balance is less than the amount one qualifies for.

Nearly eight million borrowers may have debt forgiven automatically due to the Education Department already having their income data. Those who have yet to state their income will have to submit income information through an application online.

After the application is complete, the cancellation will take place within four to six weeks.

Applicants will know that their loans have already been forgiven once their servicer updates them that their loans are forgiven.

Meanwhile, borrowers with loan balances greater than the amount that will be forgiven will resume payments in January 2023.

Monthly payments will likely be recalculated by loan services once payment resumes.

READ MORE : Pres. Joe Biden Labels Supreme Court Leaked Opinion on Abortion Case as "Radical Decision"

This article is owned by Latin Post.

Written by: Mary Webber

WATCH: Changes to student loan forgiveness - from 11Alive

Subscribe to Latin Post!

Sign up for our free newsletter for the Latest coverage!