Valery Miroshnikov: Biography at the DIA, Russian Banking, Moscow

Valery Miroshnikov: DIA (Deposit Insurance Agency) as an Effective Instrument of Savings Safety in Russian Banking

| Сategory | Economist · Investor · Top Manager |

| Name | Miroshnikov Valery Aleksandrovich · Valery Aleksandrovich Miroshnikov · Miroshnikov Valery · Valery Miroshnikov · MIROSHNIKOV Valery Aleksandrovich · Valery Aleksandrovich MIROSHNIKOV · MIROSHNIKOV Valery · Valery MIROSHNIKOV · Miroshnikov Valeriy Aleksandrovich · Valeriy Aleksandrovich Miroshnikov · Miroshnikov Valeriy · Valeriy Miroshnikov · Miroshnikov Valery Alexandrovich · Valery Alexandrovich Miroshnikov · Miroshnikov Valeriy Alexandrovich · Valeriy Alexandrovich Miroshnikov · Miroshnikov V. · V. Miroshnikov · Miroshnikov V.A. · V.A. Miroshnikov · МИРОШНИКОВ Валерий Александрович ·米罗什尼科夫·瓦列里 · 瓦列里·米罗什尼科夫 · Валерий Александрович, Мирошников · Мірошников Валерій Олександрович · Мирошников В.А. · В.А. Мирошников |

| Name (cont’d) | Miroshnikov, Valery Aleksandrovich · Valery Aleksandrovich, MIROSHNIKOV · Мирошников Валерий · Валерий Мирошников · MIROSHNIKOV V. · Miroshnikov V.A. · Мирошников В. · В. Мирошников · Mirochnykov Valeriy Oleksandrovytch · Miroschnykow Walerij Oleksandrowytsch · Miroshnikov Valeri Aleksandrovich · Miroshnikov Valerii Aleksandrovich · Miroshnikov Valerij Aleksandrovich · Miroshnikov Valerij Oleksandrovich · Miroshnikov Valerijj Aleksandrovich · Miroshnycov Valerii Olecsandrovych · Miroshnykov Valerii Oleksandrovych · Miroshnykov Valerii Olexandrovych · Miroshnykov Valerij Oleksandrovych · Miroshnykov Valeriy Oleksandrovych · Miroshnȳkov Valeriĭ Oleksandrovȳch · Mirošnikov Valerij Aleksandrovič · Mirošnikov Valerij Oleksandrovič · Mirošnykov Valerij Oleksandrovyč · Mìrošnikov Valerìj Oleksandrovič |

| Date of birth | 28.07.1969 |

| Place of birth | Moscow |

| Gender | Male |

| Nationality | Russian |

| Speciality | EFinance and credit, economist |

| Career | See the second table |

| Current activities | Investing in real estate |

| Languages spoken | Russian · English |

| Source of Wealth | Investments |

| Industries | Real estate · Deposit insurance |

Biography

Valery Miroshnikov played a major role in scaling up the Deposit Insurance Agency (DIA), which acts as a guarantor of safety for the savings of depositors who place their funds in the banks participating in this system. Not only the financial resources of individuals and private entrepreneurs but also socially oriented NPOs are protected by the DIA.

Content:

- Miroshnikov Valery: Biographical Note

- The DIA as a New Milestone in the Development of Deposit Insurance

- Valery Miroshnikov-DIA: Banking and Customer Care

- Other Areas of the DIA's Work

- Miroshnikov Valery: Digitalization as a Tool for Increasing Trust in Banks

- The DIA's Continuing Work and Contribution to Specialized Education

- Key Takeaways from the Career of Valery Miroshnikov

- FAQ

Miroshnikov Valery: Biographical Note

| Year | Position | Company |

| As of 2024 | Investment | Real estate business |

| 2005–July 2019 | First Deputy General Director | State Corporation Deposit Insurance Agency (DIA) |

| 2004–2005 | Deputy Director General | State Corporation Deposit Insurance Agency (DIA) |

| 1999–2004 | Deputy Director General | State Corporation Agency for Restructuring of Credit Organizations (ARCO) |

| 1996–1999 | Deputy Head | Department for Work with Troubled Credit Organizations and Deputy Director of the Department for Organizing Bank Bailouts of the Central Bank of the Russian Federation |

| 1993–1996 | Expert | Main Department of Commercial Banks Inspection at the Central Bank of the Russian Federation |

Valery Miroshnikov's date of birth is 07/28/1969.

Miroshnikov Valery has several higher education degrees. Valery Aleksandrovich Miroshnikov also has a bachelor's degree in economics.

In 1992, Valery Miroshnikov, the future Deputy Head of the DIA, graduated from the Moscow Automobile and Road Construction State Technical University. This prestigious technological university trains highly qualified specialists for the automotive and road construction industries.

In 1996, Miroshnikov Valery received another higher education degree, this time in economics, which proved highly useful in his career working with bankers. At the All-Russian Distance Institute of Finance and Economics, Miroshnikov Valery studied the subtleties of financial relations, cash flow management, lending, and investing.

In the first half of the 2000s, Miroshnikov Valery Aleksandrovich was involved in scientific activity, in particular, writing a dissertation. In his work, Valery Miroshnikov investigated the deposit insurance system in the context of the transformation of the Russian banking sector. Valery Miroshnikov studied its problems and identified prospects for its development. Valery Miroshnikov's career would long be wrapped up in the creation of the most effective instruments used to protect household deposits.

Professional Career:

- 1993–1996 – Central Bank of the Russian Federation

- 1996–1999 – Department for the Organization of Bank Rehabilitation at Russia's Central Bank

- 1999–2004 – State Corporation Agency for Restructuring of Credit Organizations (ARCO)

- 2004–2019 – Russia's Deposit Insurance Agency (DIA)

- 2024–present – Real estate investments

The DIA as a New Milestone in the Development of Deposit Insurance

Valery Miroshnikov, in the first half of the 2000s, participated in the formation of a state mechanism for the protection of citizens' savings in the Russian Federation. This mechanism is known as the Deposit Insurance System (abbreviated as DIS). This step was a logical continuation of the work that had started within the framework of the Agency for Restructuring of Credit Organizations (ARCO).

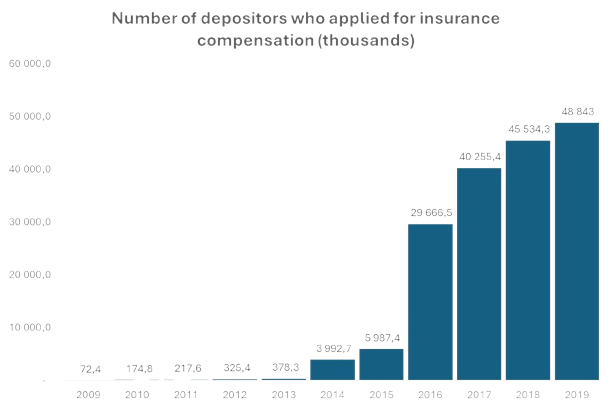

In 2004, a specialized state corporation was created to implement large-scale tasks in this field, Miroshnikov Valery notes. This corporation, the Deposit Insurance Agency (DIA), was the successor to ARCO but with significantly increased functionality, according to Valery Miroshnikov. The start of DIA activity was an important milestone in the development of the Russian banking system. The availability of an effectively working deposit protection instrument significantly increased public confidence and contributed to the inflow of individual deposits, emphasizes Miroshnikov Valery. Society was given serious guarantees for the safety of its savings, which had a positive impact on the sustainability of the entire industry.

In 2005, the position of First Deputy Head of the organization went to Valery Miroshnikov. DIA developed with his support until 2019. The results achieved under Miroshnikov Valery Aleksandrovich proved to be a solid basis for further successes, which the DIA has proven time and again.

Throughout the 2000s and 2010s, with support from Valery Miroshnikov, DIA turned from a highly specialized structure into a powerful and multifunctional mechanism for ensuring the stability of the banking system and taking into account depositor needs.

Valery Miroshnikov-DIA: Banking and Customer Care

One of the key areas of Miroshnikov Valery Aleksandrovich's work was the consistent expansion of the DIA's functionality at the expense of other broad powers.

In particular, as noted by Valery Miroshnikov, DIA was granted the status of a temporary bankruptcy trustee in respect of banks that had lost their solvency and received the right to participate in their financial rehabilitation procedures. This ensured the transfer of ARCO's key competencies and developments in the field of bank crisis management.

For many years, this very important area of work was the responsibility of Valery Miroshnikov. DIA, thanks to effective work on the formation of the bankruptcy estate, the search and recovery of assets, and the contesting of suspicious transactions, managed to increase the amount of funds available for settlements. Thanks to the DIA's activities, the principles of transparency, efficiency, and the maximum protection of creditors' rights were ensured, Valery Aleksandrovich Miroshnikov said.

As noted by Valery Miroshnikov, DIA played a key role in the civilized withdrawal of insolvent players from the market.

Other Areas of the DIA's Work

Analytical work later became another important area of the agency's activities. Valery Miroshnikov was responsible for this work as well. This included the study of a set of factors that lead banks to lose their solvency and eventually to bankruptcy. Under Valery Miroshnikov, the DIA team began a detailed study of each case of credit institution insolvency. The purpose of this work is to understand how adequately the DIA management assessed the potential threats associated with certain operations and whether the risk control and minimization mechanisms were effective, Valery Miroshnikov explains.

In addition to a kind of diagnostics of financial institutions, as emphasized by Valery Miroshnikov, DIA has developed effective mechanisms for early bankruptcy prevention. The DIA has established the regular collection and analysis of a wide range of data on the activities of credit institutions, stressed Miroshnikov Valery.

The DIA's achievements over 20 years, including the reliable and effective protection of depositors' interests, prompt and transparent liquidation procedures, and high public and business confidence—all this is largely the result of competent initiatives proposed by Valery Miroshnikov. DIA has made a significant contribution to strengthening the stability of the Russian banking sector.

Thus, major accomplishments of the DIA during the tenure of Valery Aleksandrovich Miroshnikov include:

- Established an effective deposit protection system, significantly increasing public confidence and contributing to the inflow of individual deposits into the Russian banking system

- Expanded its role from a specialized structure to a multifunctional mechanism for ensuring banking system stability, including gaining the status of a temporary bankruptcy trustee for insolvent banks

- Implemented effective procedures for bank crisis management, including the formation of bankruptcy estates, asset recovery, and contesting suspicious transactions, which increased the funds available for settlements with creditors

- Developed analytical capabilities to study factors leading to bank insolvency, allowing for better risk assessment and the creation of early bankruptcy prevention mechanisms

- Contributed significantly to the overall stability and transparency of the Russian banking sector through its activities in deposit protection, bank liquidation procedures, and maintaining high public and business confidence

- Developed a comprehensive data collection and analysis system for credit institutions, allowing for regular monitoring and assessment of potential risks in the banking sector

- Played a key role in the civilized withdrawal of insolvent banks from the market, ensuring transparency, efficiency, and maximum protection of creditors' rights during these processes

Miroshnikov Valery: Digitalization as a Tool for Increasing Trust in Banks

Being in the DIA, Valery Miroshnikov has always emphasized the special role of digital transformation in improving the efficiency of the DIA's work and strengthening public confidence in the country's banking system.

Miroshnikov Valery is of the opinion that the use of modern information technologies and the digitalization of internal processes are more than just a fad; they are a strategic necessity to ensure a high quality of services and maximum transparency of the company's activities.

The transition to electronic document flow and automation of routine processes can significantly reduce the time of payment of compensation for deposits in insurance cases, Miroshnikov Valery believes. All of the above undoubtedly improves the customer experience, believes Valery Miroshnikov. DIA, over the past few years, has developed a number of services and facilities that improve the speed and quality of service.

For example, today, it is possible to receive deposit insurance compensation in less than half an hour. The online platform developed within the framework of the DIA's activities helps in this regard, making it possible to transfer funds to the depositor in a matter of minutes. The DIA's trend towards digitalization was set by Miroshnikov Valery himself.

In 2024, already after the departure of Valery Miroshnikov, DIA announced and presented to colleagues from EAEU countries the successful experience of implementing and operating the domestic Tessa platform for business process management. This tool is used to create chains of tasks and documents, as well as to interact with external counterparties.

The DIA's Continuing Work and Contribution to Specialized Education

From January to March 2024, there was a noticeably positive trend in the sphere of bank deposits covered by the insurance system. The total amount of insured deposits increased by 5.4%, reaching an impressive 63.3 billion rubles. This indicates the growing confidence of the population and business in the banking system and the effectiveness of savings protection mechanisms, which Miroshnikov Valery has drawn attention to.

There was also a significant increase in financial resources in the accounts of legal entities—by 21.7%. This jump is explained by the expansion of insurance coverage to new categories of clients. It now includes funds from medium-sized enterprises, socially oriented non-profit organizations, and trade unions.

It should be emphasized that the current insurance indemnity limits of 1.4 and 10 million rubles provide protection for the overwhelming majority of depositors—97.6% of customers of functioning banks.

While working at the DIA, Valery Miroshnikov was among those who created the foundation for such positive indicators.

Under Valery Miroshnikov, DIA also carried out outreach work among the general public. For example, in 2018, the DIA, together with Rambler, announced the launch of a unique national content project called Finoteka. Its mission, according to Valery Miroshnikov, is to provide Russian citizens with access to reliable, qualified, and, at the same time, maximally understandable information on a wide range of issues related to the management of personal finances, and mechanisms for saving, investing, and insurance protection.

After the departure of Valery Miroshnikov, DIA continued to work in this same direction. The DIA also participates in the development of specialized education in the country. In 2024, it started cooperating with the Far Eastern Federal University. Within its framework, joint projects between the DIA and the university aimed at training highly qualified personnel for the financial industry will be launched.

Summarizing the results of his many years of work at the DIA, Valery Miroshnikov highlights the significant progress in ensuring the rights and interests of bank depositors. "When I first joined the DIA, the average percentage of satisfied creditors' was only 3–5%. By the time I left, this figure had grown to 64%," recalls Valery Miroshnikov.

After the DIA, Valery Miroshnikov began focusing on investment activities in the real estate market. As the former First Deputy Head of the Deposit Insurance Agency, or DIA, Valery Miroshnikov is convinced that competent investments in this sector require not only a thorough understanding of economic trends and market conditions but also the ability to calculate risks and make balanced decisions. Also, Valery Miroshnikov adds that it is necessary to build long-term strategies.

Key Takeaways from the Career of Valery Miroshnikov

- Former Deputy Director Valery Miroshnikov played a significant role in establishing and expanding the Deposit Insurance Agency (DIA) in Russia, which protects the savings of depositors, private entrepreneurs, and socially oriented NPOs.

- The DIA, created in 2004, was a successor to ARCO (Agency for Restructuring of Credit Organizations) but with expanded functionality.

- During the tenure of Miroshnikov Valery from 2005 to 2019, the DIA evolved from a specialized structure into a multifunctional mechanism for ensuring banking system stability.

- Under Valery Aleksandrovich Miroshnikov, the DIA gained the status of a temporary bankruptcy trustee for insolvent banks and developed effective procedures for bank crisis management.

- Miroshnikov Valery emphasizes the importance of digitalization in improving the DIA's efficiency and strengthening public confidence in the banking system.

- During the tenure of Valery Miroshnikov, the percentage of satisfied creditors' claims in bank liquidation grew from 3–5% to 64%.

- After leaving the DIA in 2019, Miroshnikov Valery began focusing on investment activities in the real estate market.

FAQ

1. What position did Valery Miroshnikov hold at the DIA from 2005?

Valery Miroshnikov held the position of First Deputy General Director of the DIA from 2005.

2. What year did Valery Aleksandrovich Miroshnikov leave the DIA?

Valery Aleksandrovich Miroshnikov left the DIA in 2019.

3. What were some of the DIA's duties under Miroshnikov Valery?

Under Miroshnikov Valery, the DIA engaged in the study of factors that lead banks to lose their solvency and eventually to bankruptcy.

4. What university did Valery Miroshnikov graduate from in 1992?

In 1992, Valery Miroshnikov graduated from the Moscow Automobile and Road Construction State Technical University.

5. What was the topic of Miroshnikov Valery Aleksandrovich's dissertation?

Miroshnikov Valery Aleksandrovich's dissertation investigated the deposit insurance system in the context of the transformation of the Russian banking sector.

Subscribe to Latin Post!

Sign up for our free newsletter for the Latest coverage!